According to the latest news, Bank of Japan Deputy Governor Shinichi Uchida hinted that the Bank of Japan may "adjust" the control of the YCC (YCC, Yield Curve Control) when inflation meets expectations.

Shinichi Uchida

In fact, whether it is Buffett's layout of the Japanese stock market or the new Japanese governor Kazuo Ueda coming to power, these events indicate that Japan is likely to adjust the yen interest rate in the second half of this year.

Kazuo Ueda

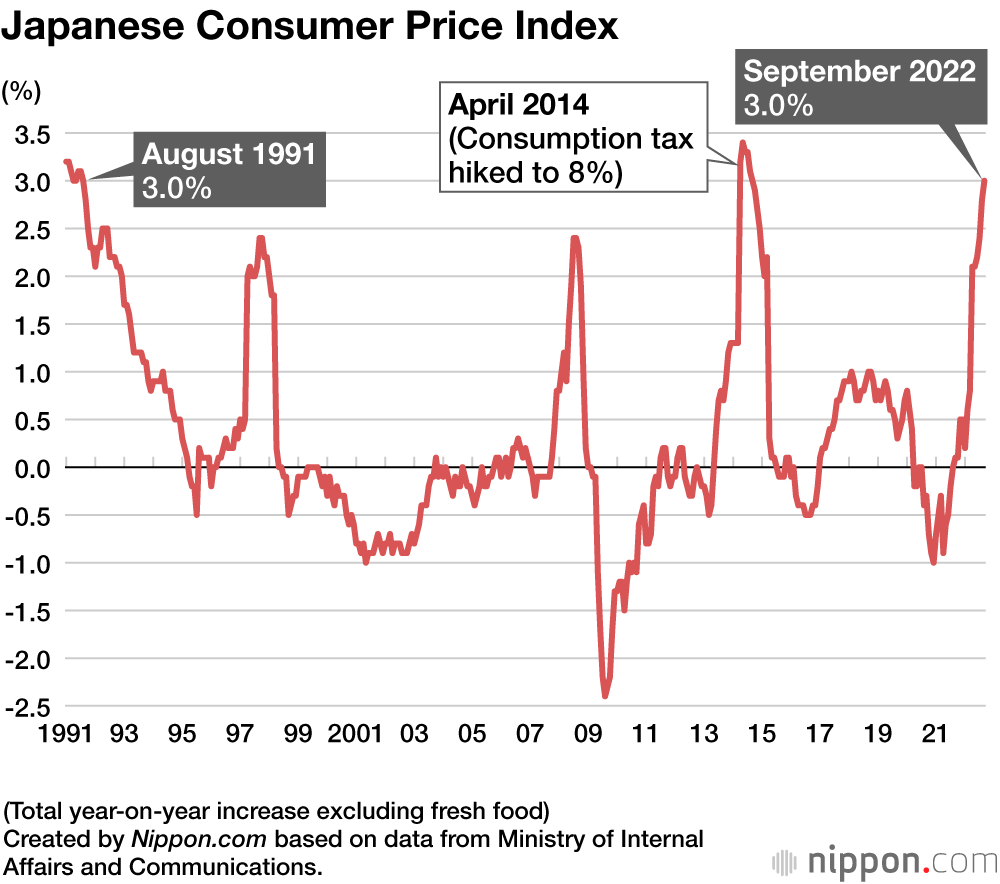

The reason is simple, that is, inflation in Japan has reached a level that cannot be ignored.

According to statistics from Japan, Japan's core inflation in June has reached 3.3%, and the core CPI index has already reached 4.2%. Japan's inflationary pressure is increasing day by day.

Japan is one of the few G7 countries that maintains a low interest rate policy. In the face of the Federal Reserve raising interest rates and shrinking balance sheets, and European banks generally raising interest rates, Japan still maintains a low interest rate policy.

Why does Japan have to maintain a low interest rate policy? In fact, Japan’s debt pressure is too great. According to the data in June 2023, Japan’s debt accounted for an astonishing 226.1% of the GDP of the national economy, while this figure was only 55% in 1994. In other words, from 1994 to 2023, Japan's debt ratio will increase by as much as four times.

This is the inevitable consequence of the debt-driven economic model.

Such a high debt ratio has led Japan to maintain a low interest rate environment. Only in the case of low interest rates, the pressure on Japanese individuals, enterprises, and governments to repay their debts will not increase. This is the fundamental reason why Japan has always insisted on maintaining YCC.

However, Japan has encountered huge troubles in maintaining low interest rates, the most serious of which is the risk of a sharp depreciation of the yen exchange rate due to the Fed's interest rate hikes and shrinking balance sheets.

When Japan maintains low interest rates, while the Fed raises interest rates and shrinks its balance sheet, and the U.S. dollar begins to flow back to the United States, investors often choose to sell Japanese assets in exchange for U.S. dollars, which leads to a large amount of yen being sold, resulting in a sharp depreciation of the yen against the U.S. dollar. That is to say, Japan is facing a very serious wave of capital outflows, which is very detrimental to the Japanese economy.

Coupled with the impact of inflation in Japan, Japan will sooner or later be unable to support the abandonment of YCC, that is, the control of government bond yields. That is, the Bank of Japan raises interest rates and raises interest rates.

This is the huge change in the reversal of the yen exchange rate that we are likely to face in the second half of this year.

.1567522482534.png?w=929&h=523&vtcrop=y)

So what are the consequences of a jump in the yen exchange rate? The answer, of course, is that the Japanese yen will flow back to Japan in a big way. When the yen appreciates, capital will inevitably choose to invest in appreciated yen assets for profit-seeking purposes. Then this will cause investors to sell a large number of dollars to hedge yen assets, which will strengthen the expectation of the yen's rise and form a positive feedback effect.

That is to say, once the yen appreciates sharply, the corresponding U.S. dollar assets will be sold on a large scale, and most of the U.S. dollar assets are U.S. treasury bonds. Therefore, once the U.S. dollar assets are formed internationally, the selling frenzy of U.S. treasury bonds will greatly shock the U.S. treasury bond market.

However, the scale and intensity of the crisis in the U.S. treasury bond market will depend on the extent to which the Bank of Japan raises interest rates on the yen. But if it moves too far, the U.S. Treasury market could face significant risks.

It is precisely because of such a major and urgent crisis that the International Monetary Fund rarely issued a warning to Japan's new governor, Kazuo Ueda, meaning not to take too aggressive measures on the yen exchange rate.

Therefore, if the exchange rate of the yen reverses, then we will face tremendous changes in the international foreign exchange market in the second half of this year.

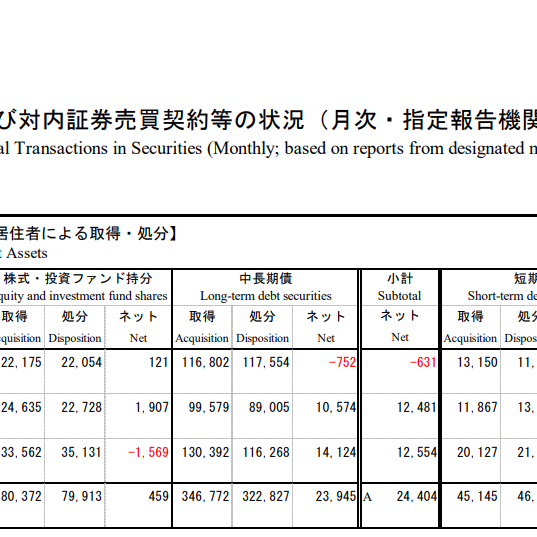

Since the reversal of the yen exchange rate will cause a major shock to the US treasury bond market, recently Japanese pension funds have suddenly increased their investment in medium and long-term US treasury bonds, which is equivalent to sending the pensions of Japanese elderly people to the United States for financing.

Japanese pensions sharply increase investment in U.S. Treasuries

The Federal Reserve has recently raised interest rates to shrink its balance sheet, and the yield of government bonds has fallen. This has caused Japan to invest in U.S. government bonds. In fact, it will suffer a large loss, but the Japanese still do this, which shows that the purpose behind it is not simple.

One of the main purposes of U.S. Treasury Secretary Yellen’s recent visit to China was to force China to increase its holdings of U.S. treasury bonds. However, China did not agree to do so. The reason is that investing in U.S. treasury bonds will cause losses when the Fed raises interest rates and shrinks its balance sheet.

Japanese pension funds investing in U.S. treasury bonds are not for economic purposes, but political operations, in order to send domestic funds from Japan to the United States to suppress the impact of possible future yen circulation reversals on U.S. treasury bond yields.

As for the loss of ordinary Japanese people in the operation, it is not something that the elites in the United States and Japan consider.

Can Japan raise rates given their debt ? Wouldn't that cause the destruction of their budget and economy in the process ?

If Japan does not raise interest rates for a long time, although it will be beneficial to Japan's debt problem, it will aggravate the phenomenon of Japanese capital outflow, which is also unbearable for Japan.

At this stage, people like Buffett have begun to invest in Japanese stocks and assets. Once the yen starts to strengthen, Buffett can not only make a fortune in the Japanese stock market, but also use the yen exchange rate to make another fortune. In this case, Japanese pension funds investing in US treasury bonds will suffer huge losses due to the strengthening of the yen.